Terrell auto title loans offer swift funding secured by your vehicle, with key steps involving valuation, fees (including processing and interest), and rate calculation. Understanding associated costs, comparing local rates, and considering loan terms, collateral, and credit are crucial for informed decisions when exploring Terrell auto title loans. Shopping around empowers borrowers to secure optimal loan conditions.

“Uncovering the fees behind Terrell Auto Title Loans is essential for any borrower. This guide aims to demystify the costs associated with these unique financing options, providing a clear understanding of what to expect. From application charges to potential interest rates, we’ll break down the common expenses. Learn how to navigate and compare different lenders to secure the best deal for your Terrell auto title loan needs, ensuring financial peace of mind.”

- Understanding Terrell Auto Title Loans: Fees Explained

- Common Costs Associated with These Loans

- How to Compare and Save on Loan Fees

Understanding Terrell Auto Title Loans: Fees Explained

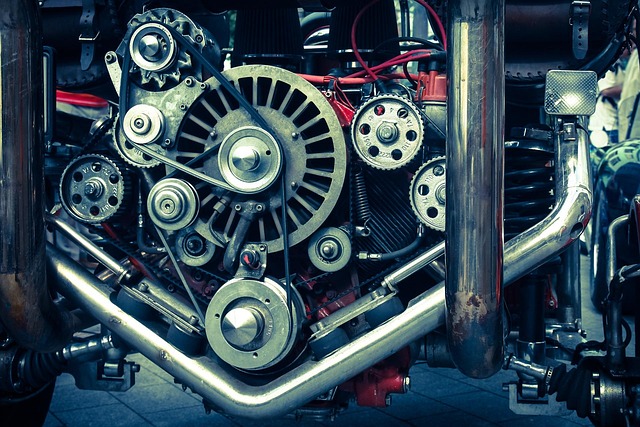

Terrell Auto Title Loans offer a unique financial solution for individuals seeking quick access to cash. These loans are secured by the value of your vehicle, allowing lenders to provide fast cash based on its appraisal. Unlike traditional loans that require extensive documentation and a lengthy approval process, Terrell auto title loans streamline this procedure. The primary fee structure involves charges related to the vehicle’s valuation, processing, and interest rates.

The initial step includes a thorough assessment of your vehicle’s worth, known as the vehicle valuation. This process determines the loan amount you can secure. Lenders will consider factors such as the make, model, age, and overall condition of your vehicle. Once approved, there are usually fixed fees for processing the title loan, which cover administrative costs. Interest rates vary among lenders but are typically calculated as a percentage of the loaned amount over a specified period. Understanding these fees is crucial when considering Dallas Title Loans or any similar auto-secured financing options.

Common Costs Associated with These Loans

When considering Terrell auto title loans, it’s crucial to understand the common costs associated with this financial solution. These loans, secured by your vehicle’s title, often come with reasonable interest rates compared to traditional personal loans. However, the overall cost can vary depending on several factors, including loan term, amount borrowed, and lender policies.

In addition to the principal and interest, there are other fees to consider. Some lenders may charge processing fees, documentation fees, or early repayment penalties. The Loan Eligibility criteria in Terrell also play a role; higher-risk borrowers might face higher interest rates and additional charges. For San Antonio loans specifically, it’s important to research local regulations and compare rates from multiple lenders to ensure you’re getting the best terms for your Terrell auto title loan.

How to Compare and Save on Loan Fees

When considering Terrell auto title loans, it’s crucial to understand that fees can vary significantly between lenders. To save on costs, borrowers should take a proactive approach in comparing loan offers. Start by gathering quotes from multiple reputable lenders who specialize in Terrell auto title loans. Key fees to scrutinize include origination charges, interest rates, and any additional processing or administrative fees. Remember that these fees are often expressed as an annual percentage rate (APR), so look for the full breakdown to make informed decisions.

Next, consider the value of your vehicle collateral. Since Terrell auto title loans are secured by your vehicle’s title, lenders will assess its market value to determine loan-to-value ratios. A higher collateral value can often lead to lower interest rates and fees. Moreover, if you have good credit or a co-signer with strong credit, you might qualify for better terms, including no credit check requirements from some lenders. Shopping around and understanding the title loan process will empower you to secure the most favorable loan conditions possible.

When considering a Terrell auto title loan, understanding the associated fees is crucial. By grasping common costs and learning how to compare options, you can make an informed decision that best suits your financial needs. Remember, savvy consumers save money by shopping around for the most competitive rates on these loans.